AEM Holdings

A study on Singapore listed company AEM Holdings. Every week, I will study 1 Singapore business listed on SGX

AEM Holdings (SGX: AWX), headquartered in Singapore, provides specialized services vital to the semiconductor manufacturing value chain through its advanced test and handling solutions. It is organized into two distinct segments: 1) Test Cell Solutions, 2) Contract Manufacturing and Instrumentation, which form the basis of its revenues and operational focus.

AEM’s technology

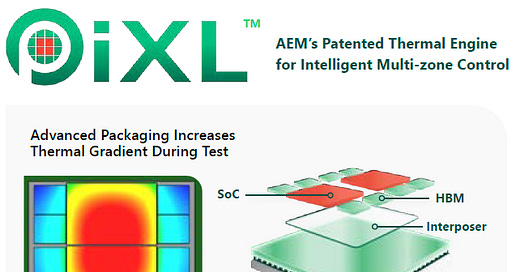

AEM positions its unique PiXL™ thermal technology as a cornerstone of its value proposition in the semiconductor test market. This patented system provides precise thermal control across the entire test insertion process, crucial for demanding AI and Advanced Packaging applications. By enabling optimized test flows and integrating eco-friendly coolants, PiXL™ aims to deliver significant cost savings, higher throughput, better yields, and improved sustainability for customers. AEM underscores this capability as one of its three core competencies (alongside Advanced Automation and Application-Optimised Test Instruments), underpinning its strategy to lead in addressing increasingly complex industry challenges.

AEM’s new generation of advanced automated burn-in system, AMPS-BI, is built for efficient high-voltage stress testing on High-Performance Computing (HPC) units and Artificial Intelligence processors.

Leveraging Factory 4.0 principles, AEM offers automation solutions for massively parallel test insertions, optimized to deliver maximum production efficiency and the lowest achievable cost of test. HPST is AEM’s high-power, advanced System Level Test platform. It is a fully automated, highly parallel, modular system designed to perform system-level testing on hundreds of devices.

The Z-Series Handlers offer high-performance solutions for diverse product lines. The Z1 tests high-power compute products, while the Z4 handles up to 512 memory integrated chips (ICs) in parallel. Both are powered by AEM’s scalable PiXL thermal engine and feature advanced automation for seamless Factory 4.0 integration.

The CWP enables testing of cryogenic quantum devices, electronics, and detectors at temperatures below 2K measured from the surface of the wafer.

AEM’s challenges and progress

The variability observed in revenue recognition during 2023 can be partly attributed to profound operational changes and execution errors, as highlighted by management. A transition involving a new ERP system, shifting production from Singapore to Penang, and adopting a build-to-stock model created internal disruption. This turbulence manifested financially in misstated inventory figures and a year-end accounting write-off. The company has assured stakeholders that corrective and preventive actions are in place, involving an auditor’s review, alongside leadership adjustments.

AEM Holdings highlighted the continued strength of its key customer relationship alongside its efforts to reduce dependency by onboarding new customers. Key strategic initiatives include developing advanced thermal testing solutions for demanding applications like HPC and integrating test processes for cost efficiency. While acknowledging potential near-term industry challenges, management remains bullish on long-term semiconductor demand fueled by AI and 5G technologies, positioning its validated "Test 2.0" solutions to capture future growth.

In 2023, AEM Holdings reported key developments across its business units. The Test Cell Solutions (TCS) division operated at the forefront of AI-driven high-performance compute testing, covering the spectrum from wafer probe to System Level Test (SLT).

In July 2024, Amy Leong assumed the role of AEM Holdings’ CEO. AEM solidified its position in high-growth AI and High-Performance Computing (HPC) testing. Its patented PiXL™ intelligent thermal management technology was highlighted as a key enabler for testing complex, high-power (>3kW) Advanced Packages and chiplets, optimizing yield and reducing cost per device for customers.

Significant progress was made in expanding beyond its traditional key CPU customer. AEM secured engagements and successes in the GPU (for AI data centers) and graphic DRAM (GDDRx) markets for System Level Test (SLT) and Burn-in applications. The company targets surpassing S$100 million in revenue from new customer wins by 2025.

The strategic move into Wafer Test gained traction, particularly in the niche Quantum Computing segment. Partnering with Bluefors, AEM strengthened its leadership in cryogenic wafer probing, successfully delivering multiple sub-2 Kelvin 300mm probers.

AEM emphasized its resilient Southeast Asian manufacturing network (Malaysia, Vietnam, Indonesia, Singapore HQ). Its subsidiary, CEI Pte. Ltd., continued to serve as a key diversification pillar in high-mix, low-volume contract manufacturing, securing notable new customers across life sciences, aerospace, and industrial segments.

Competition

Cohu is AEM's most direct and significant competitor, especially in the handler space. Cohu offers a broad portfolio of handlers (pick-and-place, turret, gravity-feed, MEMS test cells) serving diverse end markets (automotive, industrial, consumer, computing, mobility). They also have a significant presence in semiconductor test contactors and probe pins, and printed circuit board (PCB) test.

Cohu has a greater scale and a more diversified customer base than AEM. They compete across a wider range of handler types and price points. While AEM often excelled in highly customized, high-performance niches (historically tied to Intel), Cohu competes broadly and aggressively for market share. Cohu's larger scale potentially offers advantages in R&D spend distribution and manufacturing efficiencies for more standardized products.

Teradyne is a global leader in the overall Automated Test Equipment (ATE) market, primarily known for its testers (SoC, memory, wireless). While testers are their main focus, Teradyne also offers SLT solutions and robotics (Universal Robots, MiR), which can indirectly compete or complement test cell automation.

Teradyne is an ATE giant with enormous R&D resources and deep relationships across the semiconductor industry. While not primarily a handler company like AEM or Cohu, their strong push into SLT makes them a direct competitor in that crucial growth segment. Customers might prefer integrated solutions from a single large vendor like Teradyne, potentially squeezing specialized players. Their broad market access gives them significant influence.

Advantest Corporation is the other global leader in the ATE market, alongside Teradyne. Strong in SoC and memory testers. Like Teradyne, they have immense scale and R&D capabilities. Advantest's main focus is testers. However, they provide integrated test solutions that include device interfacing and handling, often through partnerships or their developments. Their sheer size and influence in setting testing standards can impact handler requirements. They also compete in the SLT space, though perhaps less aggressively than Teradyne historically. The threat lies in their ability to offer bundled solutions and leverage their existing tester placements.

Financials

AEM faces potential headwinds as its key customer, Intel, contends with a declining revenue trajectory observed from 2021 through the projected 2024 period. There’s increased competition. AMD, with its Ryzen and EPYC processors, has significantly eroded Intel’s market share in both the client computing and data center segments. While Intel CPUs are still crucial, the explosive growth in AI and High-Performance Computing relies heavily on GPUs, where Nvidia holds a dominant position. This shifts spending priorities in data centers.

AEM’s EBIT has declined from S$157 m in 2022 to S$19.82 m in 2024. This paints a stark picture of severe operational pressure and profitability compression. Intel's documented revenue decline from 2021 through 2024 directly translates into reduced demand for AEM's testing and handling solutions. This sharp EBIT drop underscores the significant vulnerability AEM faces due to its heavy reliance on Intel's capital expenditure and production volumes.

Beyond the Intel-specific issues, AEM's results reflect the broader, harsh cyclical downturn experienced by the semiconductor industry during this period. Weakening demand for consumer electronics (post-COVID boom) and inventory corrections across the supply chain have significantly impacted capital equipment spending. AEM is highly sensitive to these industry cycles.

High fixed costs inherent in the semiconductor equipment business mean that revenue declines disproportionately impact profitability. The current EBIT level raises questions about margin resilience and the company's ability to cover fixed costs effectively at lower revenue run-rates.

A successful execution of Intel's IDM 2.0 strategy, regaining process leadership, and potentially winning back market share or growing its foundry business is crucial for AEM's recovery. Evidence that AEM is successfully diversifying its customer base to mitigate the Intel concentration risk would be a major positive catalyst, though challenging in the specialized testing space.

There is a need to continue necessary R&D investments to remain competitive for the eventual recovery. In 2022, the R&D expenses were S$23.1 million. In 2023, the R&D expenses were S$24.4 million, which was a 6% increment. In 2024, the R&D expenses decreased to S$23.7 million (6% of revenue) from S$24.4 million (5% of revenue) in FY2023. It needs to continue to service debt obligations. AEM has a reasonably healthy cash balance built during the preceding boom years. However, the declining cash on a year-on-year basis is a major red flag. Its cash and cash equivalents declined from S$101.8 million as of 31 December 2023 to S$43.8 million as of 31st December 2024.

Operating Cash Flow (CFO) has decreased substantially to negative S$17.5 million in FY2024 from S$40 million in FY2023. While CFO includes non-cash charges (like depreciation) and working capital changes, the drop in core profitability is the primary driver. Working capital management becomes critical here (collecting receivables, managing inventory, and payment terms). As a technology company in the semiconductor equipment space, AEM needs to maintain some level of CapEx for R&D and equipment to stay relevant, even during a downturn, although they might curtail expansionary spending. EBIT will not even cover interest payments, taxes, essential CapEx, and potential negative working capital swings, leading to cash burn.

Conclusion

Until AEM achieves sustainable cash flow and manageable debt levels, its outlook remains speculative. Prospects are tightly tethered to an Intel turnaround, a semiconductor cycle upswing, and tangible success in broadening its customer base – challenging goals given the formidable competition from larger, more diversified players requiring constant innovation.